In light of the GOP passing their budget blueprint, I wanted to talk about a few ideas circling conservative spaces that may or may not make it into the Republicans’ final budget proposal. In 2024, Republicans popularized three ideas:

No tax on tips.

No tax on overtime.

No tax on social security.

These ideas make political sense. They sound reasonable, and they conjure images of hardworking people or retirees struggling to get by. The government looks at these hard working people and puts an additional boot on their necks known as the income tax.

The main problem with these proposals is they’re misleading. They are, as is standard, ways for Republicans to scam the American people into supporting tax cuts that mostly benefit the highest income people.

The Scam(s)

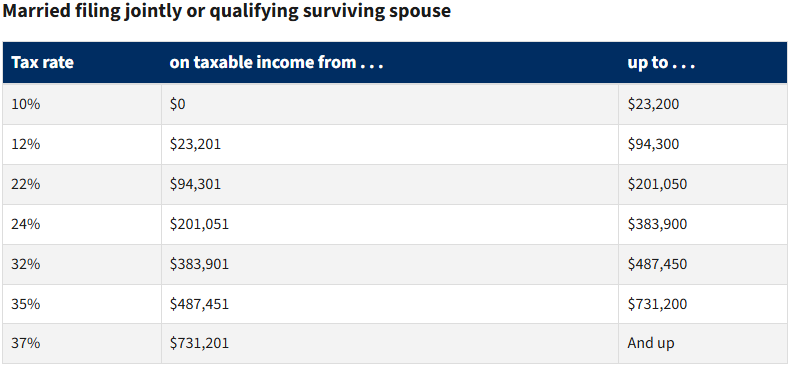

Let’s start with current income tax rates. These are a couple of the latest income tax brackets curtesy of the IRS:

These brackets might seem harsh. A single person making $47,000 per year pays around $5,000 in income taxes alone. That’s before payroll taxes and, of course, state and local taxes. This leads many to think it sensible to cut income taxes for lower-income people, but we’ve reached the first scam of the Republican proposal.

If we think lower-income Americans pay too much in taxes, why not lower the rates of tax they’re expected to pay? Take the same single person making $47,000 per year. This person owes 10% on the first ~$11,000 of their paycheck. Couldn’t we make it 8%? 6%? 0%? Of course we could, but, curiously, the GOP suggest eliminating taxes on certain types of income rather than only certain amounts.

The scam is further revealed by looking at who actually pays the income tax. The tax foundation, using data from 2023, shows that the bottom 50% of people only pay 2.3% of all income taxes raised. The effective tax rate paid, on average, by those in the bottom 50% is a little over 3%. This is because lower-income people qualify for things like the earned-income tax credit which lowers their tax obligation. There’s also something called the ‘standard deduction.’

When people file their income tax, they can choose between the standard deduction or itemized deductions. The ‘deductions’ in this case are to one’s taxable income. The standard deduction for 2024 was $14,600 for individual filers, so the first $14,600 filers make, they pay no taxes on. This, in addition to tax credits, lowers the effective tax rates of Americans, especially those at the bottom, so almost any cut in income tax on a type of income disproportionately benefits the highest earners in society.

Think of a well-off retiree named Paul. Paul makes $36,000 per year in social security and another $214,000/year in other retirement income. This brings Paul’s total income to $250,000/year. Given he’s a single filer, his final dollar is taxed at 35%. Under ‘no tax on social security’, he shaves $36,000 off the top of his income. He’s now only taxed as if he made $214,000, which a difference in initial tax liability of nearly $10,000. This is an extra $10,000 for someone already making $250,000 per year. The same dynamic exists for no tax on overtime and/or tips. Lower-income Americans stand to gain almost nothing, if anything at all, from such a set of policies.

Changing the type of income that is and isn’t taxed also adds to the U.S.’s labyrinthine tax system. It adds to a growing list of deductions and special tax benefits which disproportionately benefit the highest income people. Since lower-income people already pay almost no income tax, every change the GOP suggests like this trickles to the top.

A small extra not on social security—taxation of benefits accounts for billions of dollars a year in extra funding to the social security system. Taxation of benefits is a way to means-test benefits on the backend, using a unified tax code. So no tax on social security is not only regressive, it’s a means to defund social security as well.

The best thing the U.S. could do to balance the budget, simplify its tax code, and raise progressive revenue is eliminate all tax deductions, and replace them with either an expanded standard deduction or a universal cash benefit, but the GOP isn’t willing to go all-in on such a policy because almost every tax expenditure and carve out in the U.S.’s tax code benefits the wealthy.

With the TCJA, I see that total tax revenue did not go down. Why is that?

One claim is that without the TCJA, we would have collected more total revenue, but that is hard to know (e.g., maybe GDP goes down, or velocity of money changes).

Any thoughts or reading material?